25+ Debt to equity calculator

Using a home equity loan can be a good choice if you can afford. Determining this comes down to the debt-to-income DTI ratio.

A Founder S Guide To Calculating Cac And Ltv The Right Way Techcrunch

You can also roughly work out your equity using this calculator.

. 025 For automatic. It must not exceed 39. Enter your loans interest rate.

Non-current Liabilities 111000. A home-equity loan also known as an equity loan a home-equity installment loan or a second mortgage is a type of consumer debt. Preferred Stocks 140000.

Pay down existing debt or other needs. Second mortgage types Lump sum. Starting at 525.

ICICI Prudential Equity Savings Fund the Equity Portion is managed by Sankaran Naren Kayzad Eghlim Mr Prakash Gaurav Goel and Dharmesh Kakkad wef. Moneycontrol provides the Complete Guide to Mutual Funds Types of Mutual Funds Best Funds to Buy Mutual Fund Calculator Fund Offers Latest NAVs information and news on the net asset value. Mortgage professionals use 2 main ratios to decide if borrowers can afford to buy a home.

498 out of 5. This calculator will give you both. It allows home owners to borrow against.

ICICI Prudential Equity Debt Fund the Equity Portion is managed by Sankaran Naren and Atul Patel and Debt Portion by Manish Banthia. For example if your current balance is 100000 and your homes market value is 400000 you have 25 percent equity in the home. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

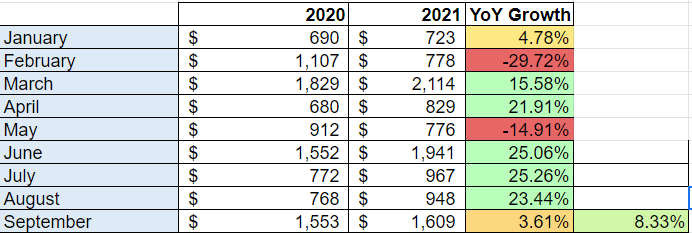

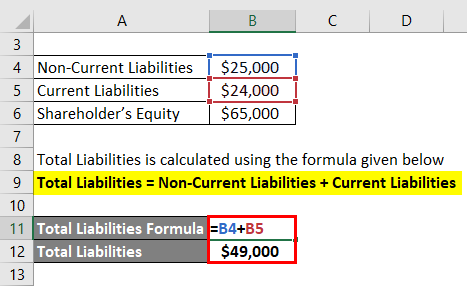

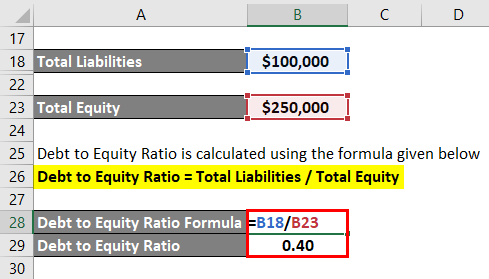

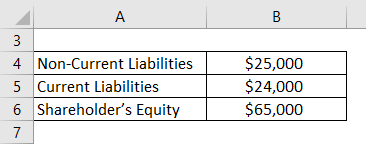

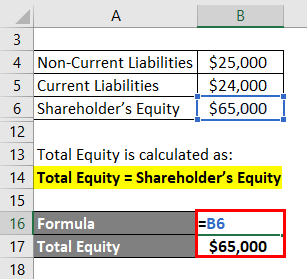

Use this Debt to Equity Ratio Calculator to calculate the companys debt-to-equity ratio. And with high interest rates the day you finally pay off your debt might be farther away than you think. Youth Company has the following information Current Liabilities 49000.

Get an estimated monthly payment and rate for a home equity line of credit with our HELOC calculator. However student loans that are under an alternative payment plan offer terms from 10 to 25 years. The deluxe Pro Max will start at 1099.

A common benchmark for DTI is not spending more than 36 of your monthly pre-tax income on debt payments or other obligations including the mortgage you are seeking. Let Bankrate a leader. Youll need a substantial amount of equity in your home to qualify for a home equity loan.

Actual payments may vary. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Second mortgages come in two main forms home equity loans and home equity lines of credit.

Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. GDS is the percentage of your monthly household income that covers your housing costs. In absolute terms affluence is a relatively widespread phenomenon in the United States with over 30 of households having an income exceeding 100000 per year and over 30 of households.

It may be assessed through either income or wealth. You can use our online equity release calculator to work out if you qualify. Find out the debt-equity ratio of the Youth Company.

Common Stocks 20000 shares of 25 each. So for example if the market price of your property is 850000 and your outstanding loan balance is 500000 you have up to 350000 of equity. It works like this.

2 codes per day. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. As of August 31 2022 Bankrate estimates the current average interest rate on credit cards at 1796 percent variable.

The calculator is provided by our equity release partner Responsible Equity Release. Gross Debt Service GDS and Total Debt Service TDS. Get 247 customer support help when you place a homework help service order with us.

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. A home equity. It means that you will never owe more than the value of your home so therell be no lifetime mortgage debt left behind on the eventual sale of your home.

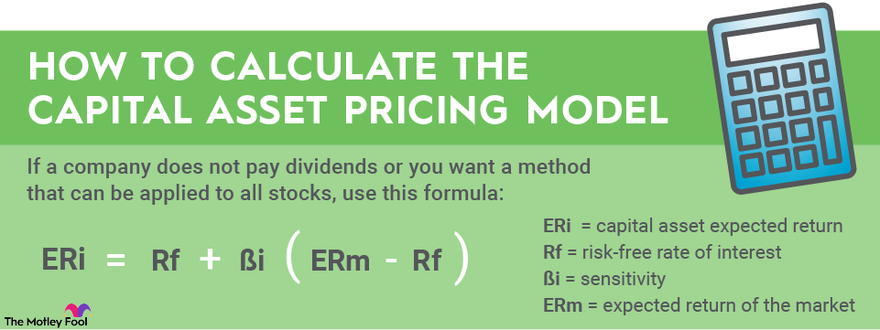

With more than 25 years experience you can be confident that youll get tailored advice based on whats. Home equity loan rates are between 35 and 925 on average. Along with being a part of the financial leverage ratios the debt to equity ratio is also a part of the group of ratios called gearing ratios.

Affluence refers to an individuals or households economical and financial advantage in comparison to others. The amount you withdraw when your account is opened may qualify you for a lower interest rate on your overall line of credit. 25 off barista-made drinks pastries.

Rising Rates Before the COVID-19 Crisis. Through the middle of 2018 homeowners saw an average equity increase of 123 for a total increase of 9809 billion. Making payments on your student loans can seem endless.

Debt Charity have a team of debt experts helping hundreds of thousands of people each year to deal with their debt problems. The calculator returns your estimated monthly payment including principal and interest. Lets take a simple example to illustrate the debt-equity ratio formula.

DTI is the percentage of your total debt payments as a share of your pre-tax income. Apply for your home equity line of credit today. 5th September 2018 and Debt Portion by Manish Banthia.

Bankrates experts compare hundreds of top credit cards and credit card offers to select the best in cash back rewards travel business 0 APR balance transfer and more. Mortgage loan basics Basic concepts and legal regulation. Debt can be expensive especially credit card debt.

In the previous example the company with the 50 debt to equity ratio is less risky than the firm with the 125 debt to equity ratio since debt is a riskier form of financing than equity. Use this calculator to get an idea of when your loan payoff date will beand ways to make that date not so far away afterall. Home equity loans typically range from 5 to 15 years.

Apples iPhone 14 now available for pre-order Pricing for base model starts at 799 while the iPhone 14 Pro starts at 899. This is the annual interest rate youll pay on the loan. Like private student loan amounts private student loan repayment terms vary by lender.

This is also known as usable equity as it is the amount you can potentially access. This means the 63 of homes across the United States with active mortgages at the time had around 8956 trillion in equity. Using home equity to help with debt.

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Nice Write Properly Your Accomplishments In College Application Resume

My Dividend Growth Portfolio Q3 Update 30 Holdings 11 Buys And 2 Sells Seeking Alpha

Weighted Average Cost Of Capital Formula

5 Rules Of Portfolio Diversification For Passive Income Dividend Investors Learn How To Properly Diversify Y Stock Trading Strategies Dividend Stock Portfolio

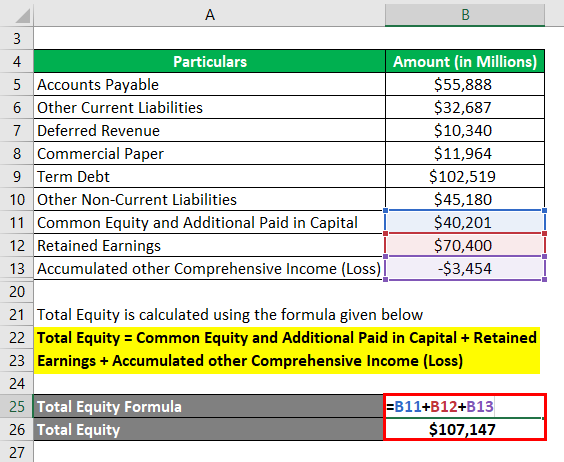

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Calculating Diluted Earnings Per Share

Weighted Average Cost Of Capital Formula

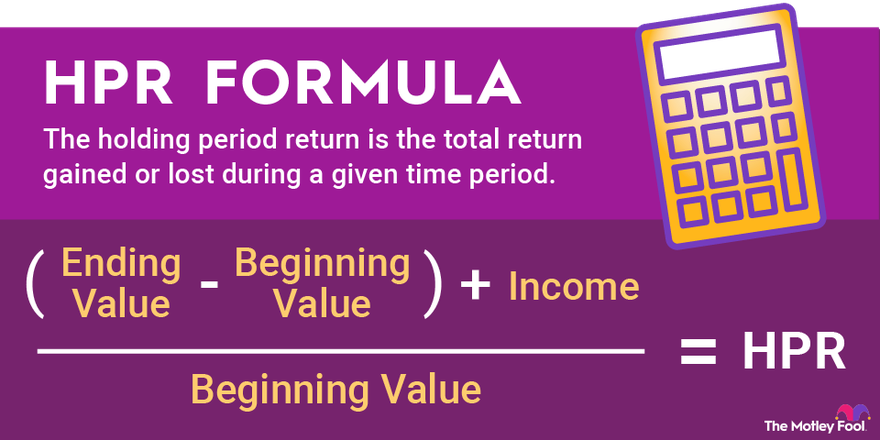

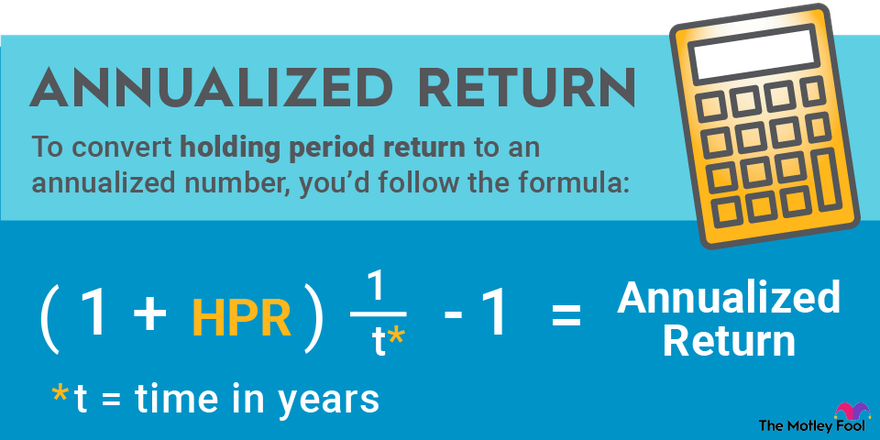

How To Calculate Holding Period Return

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Equity Ratio Formula Calculator Examples With Excel Template

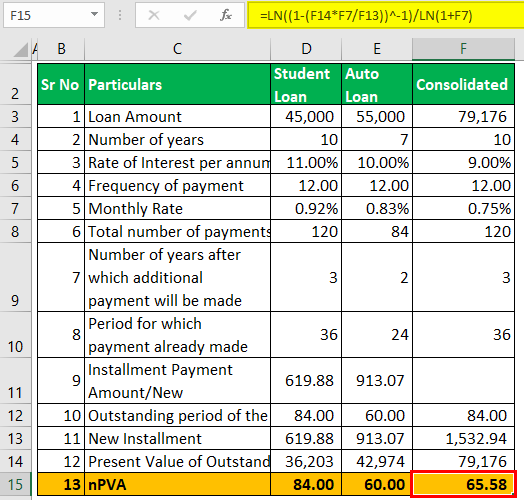

Consolidation Loan Calculator Clearance 51 Off Www Ingeniovirtual Com

How To Calculate Holding Period Return

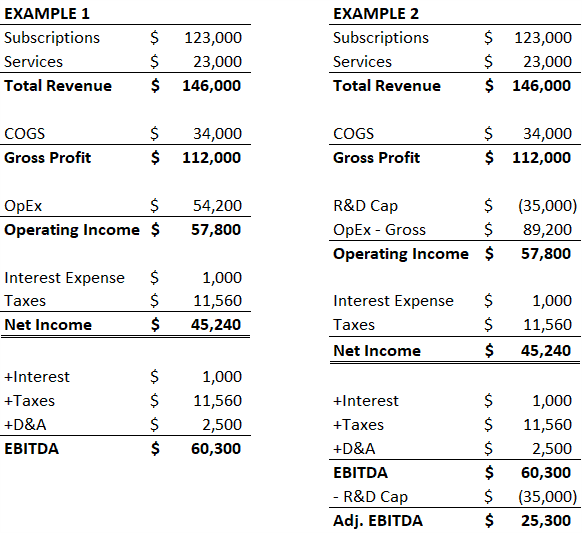

What Is Cash Adjusted Ebitda The Saas Cfo

How I Earn Over 10 Passive Income With P2p Lending